Thriving Amidst Uncertainty

By: Aaron Vaccaro, Vice President, WestRiver Group

“Don’t confuse lack of volatility with stability, ever.”

- Nassim Nicholas Taleb, mathematical statistician

The world has been a volatile place the past few years. From global pandemics and bank failures to wars and interest rate hikes, there has been plenty to make life difficult for a business of any sort, let alone a startup. Not all volatility is bad though. Take ChatGPT for example, which acquired 100 million users in two months and changed the landscape of consumer AI. Like Helen of Troy it was the app that launched 1,000 ships - many of which have already been put out of business by ChatGPT itself. A lot can change in a year.

Volatility is like gravity. It’s inevitable, it’s everywhere, and pretending it doesn’t exist will only make you look silly. Leaders must learn to accept uncertainty and work with it, rather than ignore it or fight it. At WRG, we do this through a philosophy called Model Thinking.

Model Thinking was developed over the past twenty years by WestRiver Group founder and CEO Erik Anderson, as he struggled to reconcile the pressure put on by investors with the reality of a volatile world. Investors want accurate forecasts and predictable returns. However, anyone who has built a company knows that business is unpredictable even in the best of times. There are always things we can control, and things we can’t.

While it’s not possible to eliminate volatility, it is possible to communicate more clearly with stakeholders about the choices we are making and the reasons behind them. This requires a clear picture of the elements of the business model, intellectual honesty about how well we understand the various elements, and what parts of the business are subject to volatility.

Here is our process to create structure in an inherently volatile and unstructured world.

Step 1: Identify the Variables

Like any complex system, a business can be broken down into a collection of component parts. You have products, staff, buildings, customers, marketing campaigns, profit margins, etc. The particulars vary from business to business, but with a little thought any leader should be able to break their model down into pieces. Even a simple one-man chimney sweep business has a pricing model, marketing strategy, geographical territory, labor utilization model, and profit margin, whether they know it or not.

The first step in Model Thinking is to think through your entire business model and identify the discrete elements, starting with the big picture (zoom out) and then more tangible (zoom in). Here are some examples of model elements we use in most businesses:

Each element should have metrics associated with it, even the abstract ones. For example, depending on your company’s mission you should find a way to measure whether you are achieving it. Culture is another one that people have a hard time measuring, so we suggest measuring through employee engagement scores. The point is that there is no way to measure an aspect of your business that you care about without an objective score to track.

The goal here is to create a common language for your team, board, and shareholders so that everyone is on the same page. You will be amazed at the results this step alone brings once you do the work to codify and communicate it.

Step 2: Assess your Understanding

One of the great fallacies of corporate America is the idea that a leader can have all the answers. How many times have you received a question from a potential (or existing) investor to which the correct answer was “How the #3!% would I know that? Nobody has ever built this business before!”

The truth is that there are many unknowns when building a new business. You have a hypothesis, but without market testing you don’t know whether your ideas will prove out. Sometimes customers behave in ways that are different than last year or maybe than ever before. How are we supposed to know what is inside the mind of the customer?

It’s also true that some unknowns are more important than others. For example, we don’t know which color of wood stain will create the most welcoming environment for the bar we’re designing at the new Listening Room Café. We also don’t know whether the new city we’ve chosen can provide an ample supply of talent for our songwriter shows, or whether we will have to fly in artists from Nashville to perform. Which of these unknowns do you think is more important to understand before breaking ground?

Admitting you don’t know something shouldn’t be a big deal. Unfortunately, that’s the culture of today’s business environment. That’s why Model Thinking relies on the scandalous principle of intellectual honesty. The second step in our process, once you’ve identified the elements of your model, is to assess your understanding of each.

Here is an example of a basic assessment. In this case, Vision and Purpose are clearly understood, as they created them and have conviction around them. (Side note. It’s important to not overlook this though just because it’s in your control – plenty of startups struggle with clarity of vision). Conversely Marketing and Revenue are lower on the scale. This company is still figuring out what the most effective marketing strategy for them is, and how to forecast and convert Revenue.

The next step here would be to break the elements down into their sub-elements. What about Marketing don’t we understand? Is it the allocation of spending between channels? Is our visual branding not resonating? Are we targeting the wrong market?

Finally, assign a weight to each. How important is it that we understand Marketing? Revenue? More importantly, what assumptions are we making that are mission critical? Plenty of things can go wrong and still allow successful execution. What are the things that must be true for this to work?

Remember as the captain you have the power to stop the boat. Don’t be afraid to throw the brakes on if you need to pause and figure something out, or course correct before going any further.

Step 3: Evaluate the Underlying Volatility

As much as our economist friends would like us to believe it, humans are neither rational nor predictable. Nor are weather patterns, shipping delays, or advancements in technology. Volatility, both up and down, is natural. Our best bet is to work with it, rather than pretend it doesn’t exist.

That said, some elements will be more or less subject to volatility. Rent should be well understood and involatile. You can count on the same payment coming due every month at the same time. Sales on the other hand could be chunky and subject to high fluctuations. You should be able to come up with a decent idea of where volatility will show up and to what magnitude.

Therefore, the third step in our process is to identify the embedded volatility in your model elements. You can do this with a high / medium / low score to start, but a sophisticated model will put a range around what is normal for each metric. What happens when you fall outside that range? We’ll get to that in Step 5.

Step 4: Building your Value Creation Roadmap

By now we have broken our business down into component pieces, analyzed how well we understand the knowns and unknowns, and made a guess at how much fluctuation should be expected in each. What’s next?

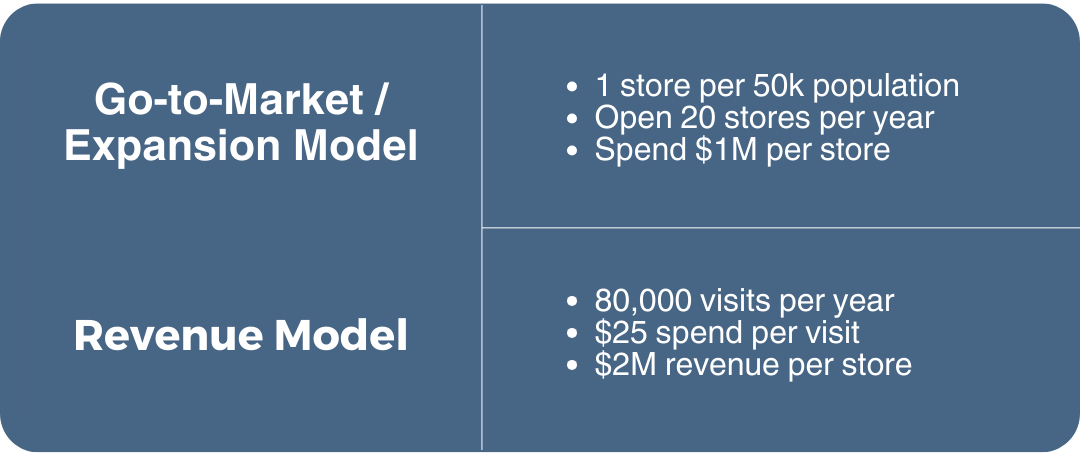

The final step before we put our model to work is to see what it all adds up to. By plugging all your model elements and assumptions into a financial model, you should have a view of what your business will look like if you successfully execute what’s on the paper. We call this the Value Creation Roadmap. The key question is, is it worth it? If you are the first company to execute perfectly, exactly as you’ve laid out in the plans, what will your business be worth? What about the in relation to the capital required to get there? Valuation and net present value could be their own blog post, so let’s assume for now that you figure out what the future looks like, and you like the result.

Congratulations – you now have a playbook for your business. All you have to do is follow it, and you will end up creating something of value. But wait! What about all that volatility stuff?

Steps 5 to N: Execute, Review, Rinse and Repeat

The beauty of the model is that is simplifies management’s dialogue to a few simple recurring questions. Day in and day out, as you execute against the plan, deal with volatility, and inevitably make mistakes, you just have to stick to the model and ask yourself these questions.

Are we on Model?

Did we make a mistake?

Are we experiencing volatility?

Is the Model correct or do we need to update it?

The first question should be black and white. Are you on model according to your chosen metric? If the answer is yes, great! Don’t change anything, just get back to it.

If the answer is no, there are a few reasons why it could be so. Sometimes, people just make mistakes. A sales contract didn’t get sent on time, a manager didn’t schedule labor properly, or we just ordered too much lettuce. None of these alone are reasons to change the model.

It could also just be our friend volatility. Perhaps a cold front came through the south and Topgolf’s weekend sales dropped precipitously. Or maybe the champion that was supposed to sign the other side of a quarter-making SaaS deal got a new job and set us back three months. Again, no reason to change the model. Some things are just out of our control – it doesn’t mean we did anything wrong or have a bad plan.

Sometimes, however, we learn something new that causes us to make a permanent change to the model. If you consistently have “volatility” in the same direction and the same magnitude, well that might just be the new normal. This can happen to the upside too. After a year of consistently outperforming our Revenue model at Topgolf Houston by 30%, we finally decided that maybe our model was too low and raised our target.

If you believe the model is correct, and you can’t point to external volatility or explicit mistakes causing you to miss the model, then you may just have the wrong people in the wrong seats. Playing the game at a high level requires high caliber athletes.

The key thing here is consistency and cadence. If you meet with your team and review all these data once a quarter, that’s 4 cycles of learning per year and 3 months to react to problems. If you look at it weekly on the other hand, that’s 52 cycles per year. Not only can you react to issues faster, the learning compounds that much faster as well.

In Summary

Operating in an uncertain world is scary and frustrating. Especially when you have raised capital. The status quo paradigm doesn’t encourage intellectual honesty, but rather chasing optimistic numbers developed to sell investors and then explaining why you missed them and how you just need more capital to really knock it out of the park.

Using our Model Thinking philosophy elevates the discourse. It brings investors and board members into the conversation, forcing them to confront the assumptions that the business model is making and which they invested in. More importantly, it acknowledges that the world is inherently unpredictable, and that predictability doesn’t mean value creation.

When you create this environment – one where it’s OK to say I don’t know, but we’ll figure it out together – only then can you thrive amidst uncertainty.